Dr. Keilani Vanish is the Business Office Assistant at Jackson State University. She assists with Financial Management, Business Operations and Human Resources. Additionally, she assists with handling the allocation and appropriation of funds, prepares cost estimates, balances accounts, deposits incoming monies and endorses checks and vouchers.

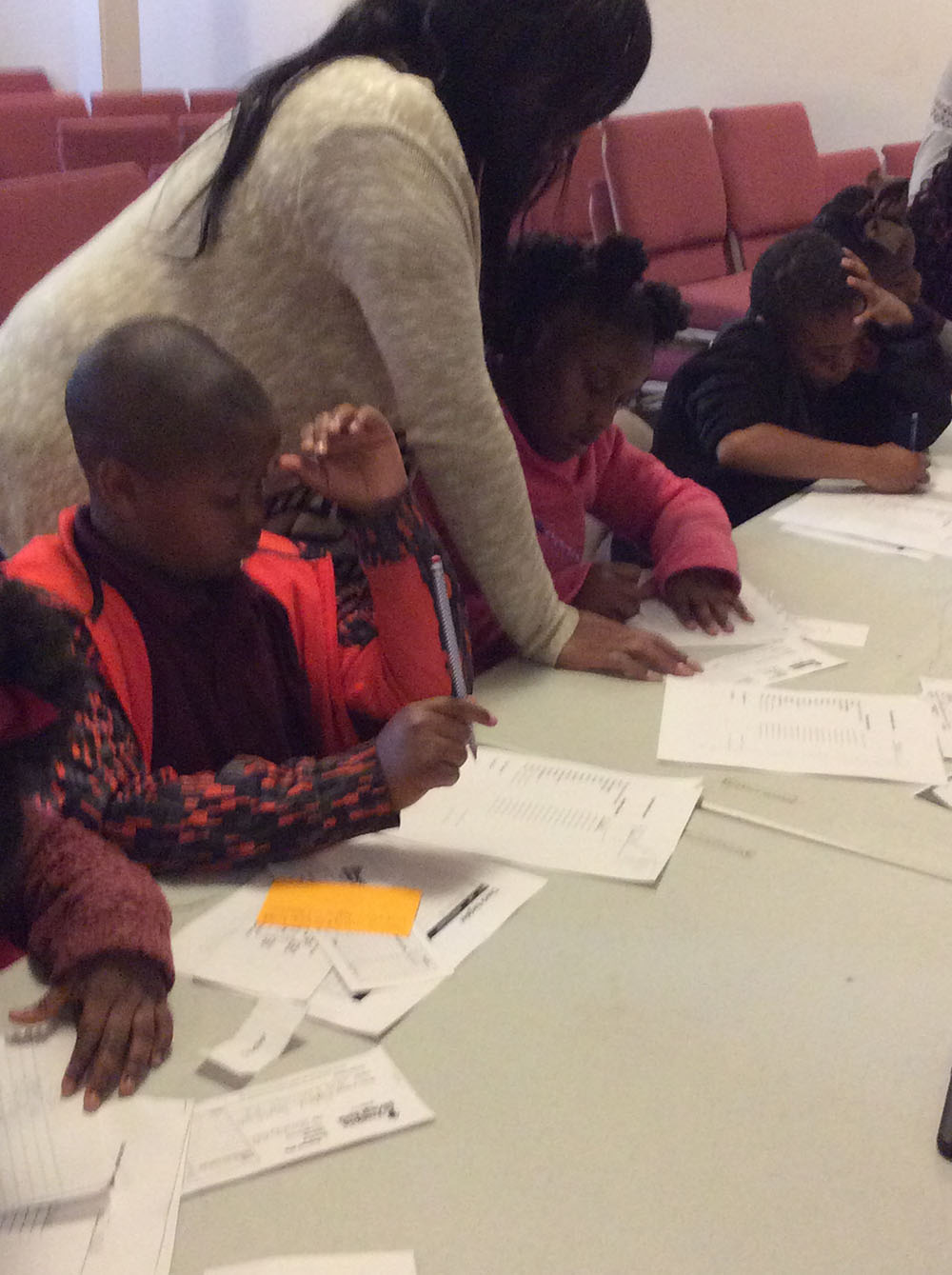

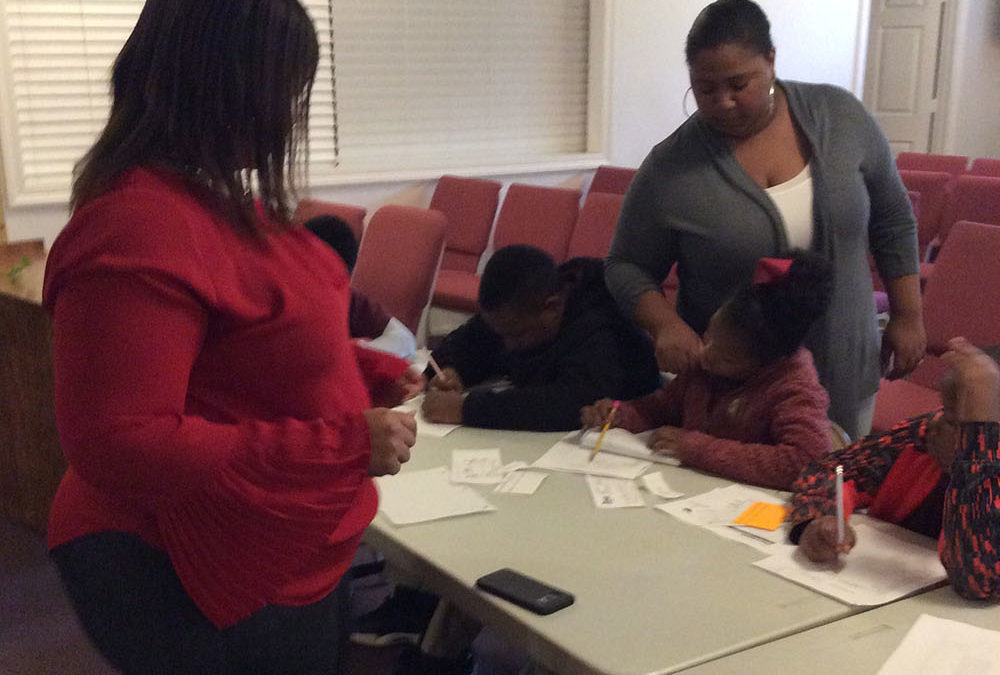

On November 28, 2018, Dr. Vanish hosted a workshop for middle school students at Grace Christian School. The workshop exposed the students to writing checks, monthly budgeting, reconciling, and financial investments.

According to researchers, students who learn to manage their finances early often become responsible adults who are better equipped to live independently. By teaching kids to make good financial decisions, they learn to pay down debt or avoid it altogether!

Students who learn to navigate the world of debt and credit will tend to have more money for savings, which can help pay for large expenses without relying on credit and they can set aside money for retirement accounts.

“Today’s workshop was very impactful. It educated us on how to manage our money and remain debt free,” states Abby Smith, a 7th grade student. Audrey Thompson, a 4th grader said, “She taught me how to use my money as I grow up and enter the work-force.”

According to Mr. Duckworth, financial literacy for students is vital to help ensure financial wellness for our youth and communities as a whole. The most effective time window for sharing positive personal finance lessons is before students move out on their own. In today’s age, young people need to master this crucial life skill. These skills are invaluable for those who desire success in life.

Dr. Vanish complimented the students. “I haven’t worked with a group of students this young. I was impressed by the maturity level of each student. It was a pleasure working with them!”

At the end of the three-hour workshop, the students were excited to take their financial management information home to continue practicing budgeting, writing checks, balancing check books, and reconciling bank statements.